Monday, June 13, 2011

Wednesday, June 8, 2011

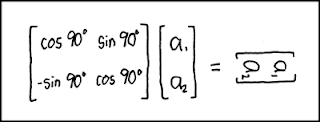

girl math: bsb harmonic range

yesterday i was taking a trip down memory lane and watching backstreet boys music videos on youtube. one of my favorites:

in mathematics, a harmonic range is the distance between four harmonic conjugates.

let's say our backstreet boys are forming collinear points by standing on a line:

in mathematics, a harmonic range is the distance between four harmonic conjugates.

let's say our backstreet boys are forming collinear points by standing on a line:

brian and nick are harmonic conjugates with respect to a.j. and howie if:

|brian * a.j.| | = | |brian * howie| |

|a.j.* nick| | |howie * nick| |

further, a.j. and howie are harmonic conjugates with respect to brian and nick.

in short, our boys divide the line in the same ratio. line brian-nick is divided harmonically at a.j. (internal ratio) and at howie (external ratio). if | brian * howie | = 1, then:

|brian * a.j.| | = | a ( 1 - a ) | |brian * nick| | = | 2a | |

1 + a | a + 1 |

all four boys form a harmonic range within our harmonic line segment!

but what if kevin wants to rejoin the group? no problem, he can stand as the midpoint between brian and nick:

then:

kevin * nick^2 = (kevin * a.j.) (kevin * howie)

who doesn't love a good 1998 bsb harmony?

Friday, June 3, 2011

made in china or trade with china?

the economist recently featured a story on the economic relationships betwixt africa and china. the chinese have been interested in the continent since the cold war and have been investing in africa since the mid-90s. the chart below shows the exponential trade growth between the two over the past 15 years.

i normally take data sets and publications from the heritage foundation with a grain of salt and a stiff drink. but this was a discussion in one of my grad school courses a couple years ago and i've heard relatively little about it since.

i normally take data sets and publications from the heritage foundation with a grain of salt and a stiff drink. but this was a discussion in one of my grad school courses a couple years ago and i've heard relatively little about it since.

but one of the more interesting things in the second chart is that china's greatest outward investment is in the americas (ex-u.s.) at 19.5%. isn't that supposedly our investment turf? and keep in mind, these numbers don't include bond (debt) transactions.

china's portfolio is pretty diverse on the surface, but the majority of their investments (66.9%) are in up-and-coming economies. if current trends continue, i'm hypothesizing china will have significant underlying influence in shaping the global economy over the next century - more so than "just being" china.

Labels:

africa,

china,

globalization,

trade

Thursday, June 2, 2011

spotlight: tontine

the tontine is the "wolf pack" system for raising capital. individuals pool their money into a permanent common fund and receive dividend payments based on their investment and the fund's performance.

until death.

if a member of the wolf pack dies, his or her shares are divided among the rest of the pack. whoever outlives the rest of the pack takes the whole pot.

lorenzo de tonti created this system in italy and france during the mid-17th century. it was later used by french, british, and u.s. governments for public initiatives, such as funding buildings and promoting life insurance sales. the state would recoup the capital pot once all the investors died.

until death.

if a member of the wolf pack dies, his or her shares are divided among the rest of the pack. whoever outlives the rest of the pack takes the whole pot.

since tontines create a "live-er takes all" incentive, today, they are prohibited in most of the u.s. and britain; the french still use a limited tontine concept.

Wednesday, June 1, 2011

girl math: topology at tiffany's

i recently accompanied a friend to tiffany & co. in search of these somerset knot earrings:

knot theory, a branch within topology, centers on the shape of our tiffany's earrings: links and knots. an ambient isotopy (stretching, shrinking, pulling, bending, twisting, or magic tricking the knot) cannot reduce the curve to an unknot (something that isn't a knot).

oh, and cutting the knot is forbidden. but why would you want to? the earrings are so pretty as is.

mathematically, knots are a set of closed, non-intersecting curves which exist in three-dimensional space. the earrings above are math knots.

this is also a math knot:

this is not a math knot:

topology ("rubber sheet" geometry) focuses on geometrical properties that are unchanged by an infinite amount of twisting, bending, pulling, shrinking, or stretching. angles, length, width, etc. don't matter - everything is elastic. a sphere is topologically equivalent to a cube (scube?); a donut is topologically equivalent to a coffee mug. because the heart of "rubber sheet" geometry is the relationship between an object's points and these properties, topology is reliant upon set theory and the theories of limits and continuum.

knot theory, a branch within topology, centers on the shape of our tiffany's earrings: links and knots. an ambient isotopy (stretching, shrinking, pulling, bending, twisting, or magic tricking the knot) cannot reduce the curve to an unknot (something that isn't a knot).

oh, and cutting the knot is forbidden. but why would you want to? the earrings are so pretty as is.

Thursday, May 26, 2011

spotlight: shadow stock markets

shadow stock markets are private, unregulated markets in which investors can purchase shares in non-publicly traded companies prior to an ipo launch. to participate in a shadow market, the securities and exchange commission requires investors to have a net worth greater than $1 million. these "accredited" investors have an early bird investment opportunity before average investor demand increases the share price; however, the accredited investor is exposed to greater risk and uncertainty, as well as lack of liquidity and disclosure requirements from the company.

a very recent and relevant example was when goldman sachs teamed up with russian investor yuri milner and pumped $500 million into facebook.

ah, the russians. of course.

a very recent and relevant example was when goldman sachs teamed up with russian investor yuri milner and pumped $500 million into facebook.

ah, the russians. of course.

Labels:

goldman sachs,

ipo,

russians,

shadow stock market,

social media,

spotlight

bubble, bubble, toil and trouble?

linkedin. zynga, groupon, facebook.

linkedin had an explosive first day of trading. the company's offer price of $45 p/s catapulted to $122 p/s and is currently trading around $95 p/s. the firm's market value nearly reached $9 billion.

there are other heavy hitters in the pipeline. zynga is rumored to launch its ipo in the next couple weeks. groupon's will be by the end of the year. and the almighty king facebook will launch its ipo in 2012.

are these social media firms really worth it? they have no organic product or service to sell - their economic value is generated from marketing other products and services. are firms that coordinate information worth billions? if so, why don't administrative assistants have higher salaries?

bring on the shorts.

linkedin had an explosive first day of trading. the company's offer price of $45 p/s catapulted to $122 p/s and is currently trading around $95 p/s. the firm's market value nearly reached $9 billion.

there are other heavy hitters in the pipeline. zynga is rumored to launch its ipo in the next couple weeks. groupon's will be by the end of the year. and the almighty king facebook will launch its ipo in 2012.

are these social media firms really worth it? they have no organic product or service to sell - their economic value is generated from marketing other products and services. are firms that coordinate information worth billions? if so, why don't administrative assistants have higher salaries?

bring on the shorts.

Labels:

ipo,

social media

Tuesday, May 24, 2011

too big to hbo

hbo premiered "too big to fail" last night. the film was based on andrew ross sorkin's novel of the same title.

when it was over, i was somehow disappointed and exhilarated.

back story: i rented the audio book from the library and listened whilst running (for some odd reason i can't just "read" nonfiction anymore); however, i accidentally heard the first two hours under my ipod's shuffle setting. william hughes, the narrator, was so compelling that i thought sorkin just had an interesting writing style. needless to say, i only made it to about chapter five before i had to return the audio book to the library.

i was disappointed that the time i invested in the novel was over in the first six minutes of the film. i enjoyed dick fuld's background and i found erin callan's story particularly intriguing. i obviously did not get very far in the book, but there was a lot of detail, emotion, and juicy gossip that just didn't have time for portrayal in the movie.

i did enjoy the humor, timeline, and questions poised throughout the film. i also forgot about how john mccain suspended his campaign to return to washington during the crisis - so thanks for reminding me. overall, the cast was great. evan handler as lloyld blankfein was my favorite, but ayad akhtar's version of neel kashkari was lukewarm.

the purpose of the novel was to humanize the 2008 financial crisis. the film did so, but failed to meet its potential, seemingly more focused on the logistical lessons learned from the immediate events which led to and the ultimate passage of the troubled assets relief program. i believe, on content, sorkin's work would have thrived as a miniseries - but i don't think it would've generated a great enough audience to merit that length.

the film didn't have the personal emotional gravitas that i was expecting - but it did make those historic events accessible to outsiders who would not have necessarily read the book. for more insight, i would highly recommend watching this 20-minute video:

and at the end of the day, the film did make me want to re-checkout the audio book from the library.

when it was over, i was somehow disappointed and exhilarated.

back story: i rented the audio book from the library and listened whilst running (for some odd reason i can't just "read" nonfiction anymore); however, i accidentally heard the first two hours under my ipod's shuffle setting. william hughes, the narrator, was so compelling that i thought sorkin just had an interesting writing style. needless to say, i only made it to about chapter five before i had to return the audio book to the library.

i was disappointed that the time i invested in the novel was over in the first six minutes of the film. i enjoyed dick fuld's background and i found erin callan's story particularly intriguing. i obviously did not get very far in the book, but there was a lot of detail, emotion, and juicy gossip that just didn't have time for portrayal in the movie.

i did enjoy the humor, timeline, and questions poised throughout the film. i also forgot about how john mccain suspended his campaign to return to washington during the crisis - so thanks for reminding me. overall, the cast was great. evan handler as lloyld blankfein was my favorite, but ayad akhtar's version of neel kashkari was lukewarm.

the purpose of the novel was to humanize the 2008 financial crisis. the film did so, but failed to meet its potential, seemingly more focused on the logistical lessons learned from the immediate events which led to and the ultimate passage of the troubled assets relief program. i believe, on content, sorkin's work would have thrived as a miniseries - but i don't think it would've generated a great enough audience to merit that length.

the film didn't have the personal emotional gravitas that i was expecting - but it did make those historic events accessible to outsiders who would not have necessarily read the book. for more insight, i would highly recommend watching this 20-minute video:

and at the end of the day, the film did make me want to re-checkout the audio book from the library.

Wednesday, April 27, 2011

nigerian sweep

the action congress of nigeria (acn), a classical liberal political party, uses the broom to symbolize they will sweep out all the bad things in nigeria. since nigeria is in the midst of an election cycle, the price of brooms is increasing dramatically and housewives are not happy. according to the wsj:

"the price of brooms has more than tripled in some places. in parts of lagos, it's difficult to find any brooms at all, illustrating the unwelcome intrusion of nigerian politics on the home front... irked housewives say they have been forced to let dust pile up, or opt for their worn-out brooms... some say broom sizes are also shrinking, another means for merchants to inflate profit margins."

apparently the acn purchases the brooms in bulk and resells them to members of the party, driving up prices. during the last election in 2007, the price of brooms didn't decline until two months after the election, leaving housewives in piles of dust.

i wonder if the acn could set up a service to purchase the brooms in bulk, rent them to party members, then resell them to the housewives' market. the renting portion of implementing that idea seems difficult, so maybe the acn could assist in establishing an actual "broom market day" where housewives and party members could buy and sell these brooms? hmmm...

"the price of brooms has more than tripled in some places. in parts of lagos, it's difficult to find any brooms at all, illustrating the unwelcome intrusion of nigerian politics on the home front... irked housewives say they have been forced to let dust pile up, or opt for their worn-out brooms... some say broom sizes are also shrinking, another means for merchants to inflate profit margins."

source: nationalmirror

i wonder if the acn could set up a service to purchase the brooms in bulk, rent them to party members, then resell them to the housewives' market. the renting portion of implementing that idea seems difficult, so maybe the acn could assist in establishing an actual "broom market day" where housewives and party members could buy and sell these brooms? hmmm...

Thursday, April 21, 2011

tim geithner - my first secretarial moment

during the winter of 2009-2010, i had the opportunity to ask tim geithner (tfg) a question. i've had many opportunities since, but this was when the unemployment rate was at 9.7%, the dodd-frank bill was proposed, and tfg himself recently extended the troubled asset relief program until the end of 2010.

i was unaware that we could ask him questions and hadn't brainstormed anything. glistening profusely (because girls don't sweat), i stood up and nervously caught tfg's eye. unlike my colleagues, i didn't ask about new derivatives rules, the housing market, or ken feinberg's role as executive compensation special master. i asked the first thing that popped into my head:

"what are your thoughts on the speculation that the dollar may not be the "go-to" currency anymore?"

i sat down quickly and maintained eye contact. at first, the only thing i heard was the voice inside my head saying "omg! omg! omg! i just asked the treasury secretary a question! i didn't mess it up or sound like an idiot!"

tfg stepped back, thought about it, and then spent a longer time answering my question than he spent speaking to our group. after i calmed down and was receptive to the moment, i could literally visualize his thought process - it was like watching economics students walk through is/lm/ad/as curves on a whiteboard in the library. but tfg knew his content and it was fascinating watching him talk us through the analytical framework behind his answer. although it was difficult to understand through some mumbling, in short, he explained that once the u.s. got its debt and spending under control, the speculation will cease and "the dollar will be fine - the united states will be just fine".

afterwards, one of my colleagues patted me on the back and said "'atta girl - he didn't have prepared remarks for your question - way to throw him a curveball".

i was unaware that we could ask him questions and hadn't brainstormed anything. glistening profusely (because girls don't sweat), i stood up and nervously caught tfg's eye. unlike my colleagues, i didn't ask about new derivatives rules, the housing market, or ken feinberg's role as executive compensation special master. i asked the first thing that popped into my head:

"what are your thoughts on the speculation that the dollar may not be the "go-to" currency anymore?"

i sat down quickly and maintained eye contact. at first, the only thing i heard was the voice inside my head saying "omg! omg! omg! i just asked the treasury secretary a question! i didn't mess it up or sound like an idiot!"

tfg stepped back, thought about it, and then spent a longer time answering my question than he spent speaking to our group. after i calmed down and was receptive to the moment, i could literally visualize his thought process - it was like watching economics students walk through is/lm/ad/as curves on a whiteboard in the library. but tfg knew his content and it was fascinating watching him talk us through the analytical framework behind his answer. although it was difficult to understand through some mumbling, in short, he explained that once the u.s. got its debt and spending under control, the speculation will cease and "the dollar will be fine - the united states will be just fine".

afterwards, one of my colleagues patted me on the back and said "'atta girl - he didn't have prepared remarks for your question - way to throw him a curveball".

source: econmodel.net

Wednesday, April 20, 2011

Tuesday, April 19, 2011

i'm not switching to diet rite

the cpi increased 0.5% this past march (seasonally adjusted) and is up 2.7% since a year ago (not seasonally adjusted). msnbc has a piece out this morning listing 13 key consumer items that currently or will cost more. these items are:

it will interesting how this plays out - i'll guess just have to drink less diet coke, which is probably a good thing. so thank you, inflation.

- airfare

- chocolate

- coffee

- fast food

- fresh produce

- furniture

- gas

- household products

- insurance

- juice

- packaged foods

- soft drinks

- tires

it will interesting how this plays out - i'll guess just have to drink less diet coke, which is probably a good thing. so thank you, inflation.

Monday, April 18, 2011

pulitzer high fives

big congrats to propublica's jesse eisinger and jake bernstein for winning the national reporting pulitzer prize on bankers involved in the financial crisis.

i thoroughly enjoyed the podcast, especially "bet against the american dream" and the associated "welcome to cdo world".

i thoroughly enjoyed the podcast, especially "bet against the american dream" and the associated "welcome to cdo world".

my favorite pecan pie chart of the day

apparently the chinese started to consume pecans when walnuts were expensive in 2007. they favored the taste, discovered the health benefits, and found them less labor-intensive than other nuts. chinese demand for the thanksgiving nut has skyrocketed and prices have almost doubled over the past three years. we now export 28% of our domestic supply to china.

source: wsj

according to the wsj article, the u.s. grows about two-thirds of the world's pecan supply. regarding u.s. domestic pecan market structure:

"...growers of walnuts, almonds and hazelnuts are organized into groups, or cartels, that can essentially set prices and decide how many nuts to sell and how many to save for the following year. Pecan growers don't have such groups, and so have no collective strategy for dealing with the Chinese or other unexpected shifts in the market."

interestingly, i found this exporting-to-china brochure from the texas pecan growers association.

hmmm maybe i should get involved in the pecan futures...

source: wsj

or, better yet, buy a pecan farm.

Friday, April 15, 2011

zipcar ipo

zipcar, the car-sharing service, launched its ipo yesterday. the company had a target of $14 to $16 per share (p/s) - but participants paid roughly $18 p/s in the initial stock offering, raising $174 million, and shares rocketed to nearly $30 p/s once the offering was opened to the public, valuing the company at $1.2 billion.

a few thoughts:

- why was there such a large price disparity between the initial stock and public offerings? did the underwriters flip the ipo or were they unaware of the demand?

- the service is very capital-intensive in an "infant industry" - but after ten years, the company has yet to post a profit even though its growth has been impressive.

- should i invest in zipcar? after all, i am technically a "zipster" because i don't have a car and frequently patron the zipcar service.

i love public companies; i'm weary of ipos, especially ones that involve short-term fads (looking at you). i don't necessarily think zipcar is a fad, but i definitely agree that it's in a specialized, concentrated market.

count me out for now, but i am intrigued and will look at the company's financials after a few quarters. i'll be looking for a smaller expansion rate, glimmer of profitability, and the impact of market competitors.

one thing's for sure, i do like the ticker.

Thursday, April 14, 2011

introduction

i saw this question in the christian science monitor (csm) that asks: where are the female economist bloggers? out of 1,000 of the top economists, only 52 women are on the list, and none of them blog. i frequently visit marginal revolution, greg mankiw's blog, calculated risk, econlog, economix, econbrowser, economist's view, paul krugman's blog, don marron's blog, the baseline scenario, grasping reality with both hands, and my new personal favorite liberty street economics; none of which are primarily authored by female economists. i then searched for female economist bloggers and found practically nothing.

i had a livejournal account in high school. i loved it. all of my friends had their own and we established a small utopian online community - one that would make socialists and phd sociologists proud. we all understood the purpose of our livejournal linkups was to reflect, laugh, and cherish high school with each other. we knew we were young for only so long and man, the internet was so innocent in 2002.

but when i went to college, some of my new classmates discovered my livejournal. they posted anonymous ugly comments about my entries and shared that online activity with other classmates. so i stopped.

fast-forward five years later and here i am. i have a bachelor's of science in economics, a master's degree in public policy analysis, and am waiting for a response regarding admission to another graduate program in economics. i live in washington, dc, and work for the federal government on a highly criticized and hated financial rescue program which stemmed from the 2008 financial crisis. i am also getting married this winter.

i tried to start a few blogs since those awful college livejournal days, but had no reason, focus, or motivation - until now.

i would hardly categorize myself as a feminist and even have this odd distrust towards women writers. in fact, this is only book authored by a woman that i have ever fully enjoyed and my fiance believes it's because the writer was from west virginia. however, i am currently the only woman on my team at work, surrounded by former regulators, investment bankers, and securities lawyers - all male. i am not even a real economist, but a financial analyst acting like one.

after i saw the csm piece (and no, i do not typically read the christian science monitor), i decided to get back into blogging. but this won't be about bonfires, rides to punk rock shows, or other forms of mischievous high school devilment. it will be about economics, etc. with glitter.

i had a livejournal account in high school. i loved it. all of my friends had their own and we established a small utopian online community - one that would make socialists and phd sociologists proud. we all understood the purpose of our livejournal linkups was to reflect, laugh, and cherish high school with each other. we knew we were young for only so long and man, the internet was so innocent in 2002.

but when i went to college, some of my new classmates discovered my livejournal. they posted anonymous ugly comments about my entries and shared that online activity with other classmates. so i stopped.

fast-forward five years later and here i am. i have a bachelor's of science in economics, a master's degree in public policy analysis, and am waiting for a response regarding admission to another graduate program in economics. i live in washington, dc, and work for the federal government on a highly criticized and hated financial rescue program which stemmed from the 2008 financial crisis. i am also getting married this winter.

i tried to start a few blogs since those awful college livejournal days, but had no reason, focus, or motivation - until now.

i would hardly categorize myself as a feminist and even have this odd distrust towards women writers. in fact, this is only book authored by a woman that i have ever fully enjoyed and my fiance believes it's because the writer was from west virginia. however, i am currently the only woman on my team at work, surrounded by former regulators, investment bankers, and securities lawyers - all male. i am not even a real economist, but a financial analyst acting like one.

after i saw the csm piece (and no, i do not typically read the christian science monitor), i decided to get back into blogging. but this won't be about bonfires, rides to punk rock shows, or other forms of mischievous high school devilment. it will be about economics, etc. with glitter.

Subscribe to:

Posts (Atom)